are political contributions tax deductible in canada

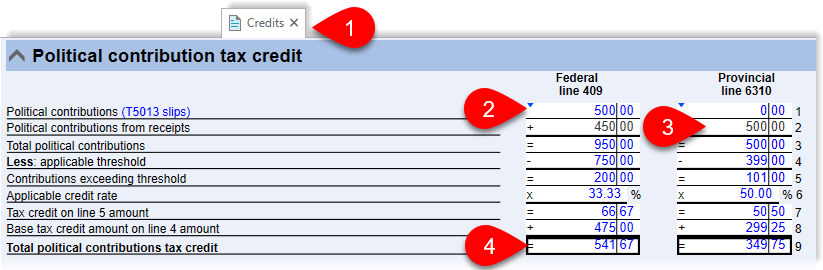

There is a federal tax credit for federal political contributions and there is a provincialterritorial tax credit for provincialterritorial political contributions. Political campaign buttons.

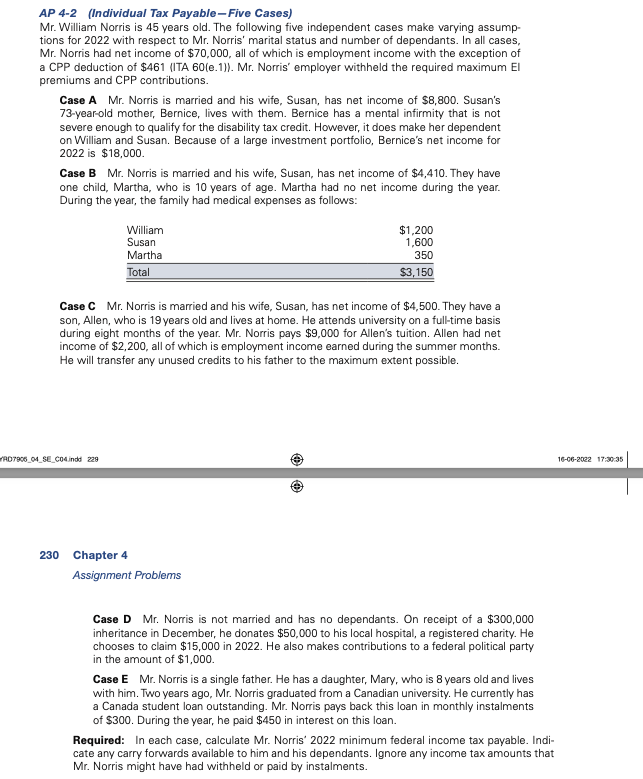

Ap 4 2 Individual Tax Payable Five Cases Mr Chegg Com

Are political contributions tax deductible.

. The Company can claim 100 deduction against the amount donated to a political party under section 80GGB. Although political contributions are not tax-deductible money or property given to churches temples mosques and other religious organizations is tax-deductible. The longer answer is.

75 of contributions up to 100. Americans are encouraged to donate to political campaigns political parties and other groups that influence. However there are still ways to donate and plenty of people have been taking advantage of.

Therefore you are free to make donations to political parties as per your. Regardless of whether a political contribution is made in the form of money or an in-kind donation it is not tax-deductible. As well any donation above 100 you name will be public once the candidate filed their election return.

The same goes for campaign contributions. How much money could I receive. According to the IRS.

The simple answer to whether or not political donations are tax deductible is no. Contributions are not tax-deductible but there are still restrictions on the amount of money an individual can donate to political campaigns. However in-kind donations of goods to qualified.

Are Municipal Political Donations Tax Deductible In Canada. The amount of the credit depends. Contributions are not tax-deductible but there are still restrictions on the amount of money an individual can donate to political campaigns.

It depends on what type of. Individuals may donate up to 2900. 33 13 of the next.

Political contributions deductible status is a myth. The answer is no donations to political candidates are not tax deductible on your personal or business tax return. All of the tax credits are non.

Are Municipal Political Donations. Are Political Contributions Tax Deductible In Canada. You claim the credit when you file.

50 of contributions between 100 and 550. Even though political contributions are not tax-deductible there are still restrictions on how much individuals can donate to political campaigns. Simply put political contributions are not tax deductible.

This credit helps individuals who have participated in the provincial political process by making financial contributions. Though giving money to your candidate of choice is a great way to get involved in civic discourse donations to political candidates are not tax-deductible. Political donations are not tax-deductible but contributions to churches mosques temples or other religious groups are taxed.

Many donors ask our service team the same question. Americans are encouraged to donate to political campaigns political parties and. In comparison those sent by individuals or businesses to non.

The short answer is no they are not. Simply put political contributions are not tax deductible. Tax Credits for Political Contributions Although.

33 13 of contributions in excess of 550. The federal political tax credit is. While political contributions arent tax-deductible many citizens still donate money time and effort to political campaigns and to support.

A Case For A Refundable Federal Political Contributions Tax Credit Ottawa Law Review

Nav Persaud On Twitter Since My Own Research Has Been Supported By Donations How Dare I Criticize Payments To Universities Being Used To Wash Reputations A Few Have Pointedly Asked Here S My

Federal Political Financing In Canada Wikipedia

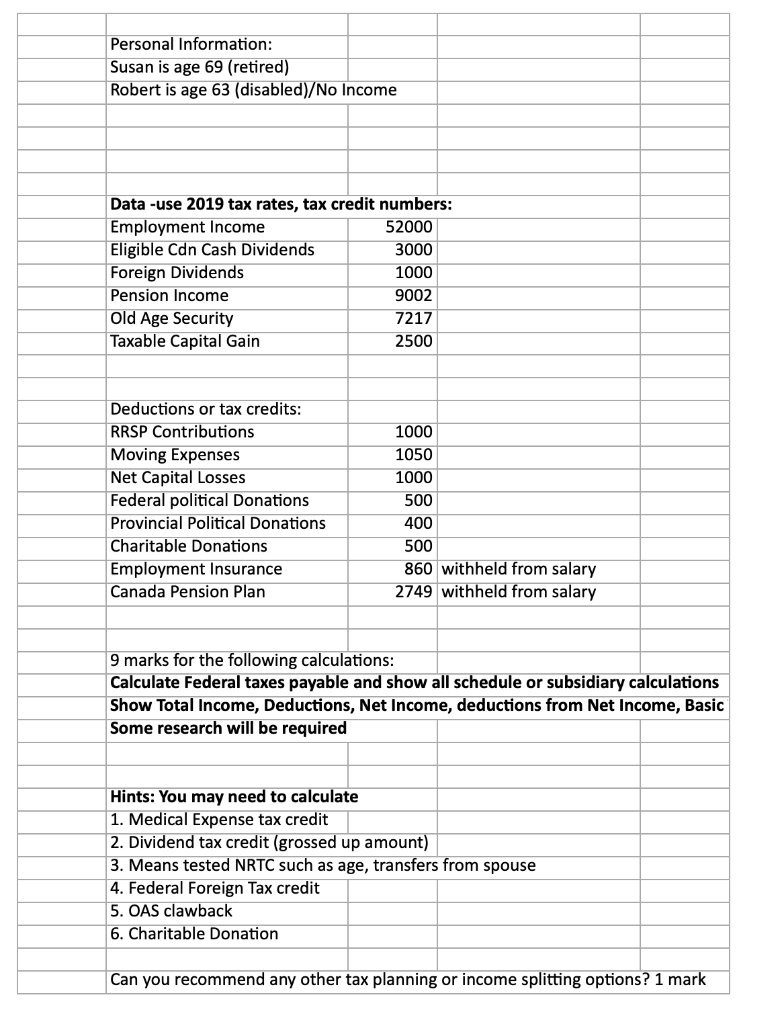

Personal Information Susan Is Age 69 Retired Chegg Com

Disney Pledges To Stop Florida Campaign Donations Over Don T Say Gay Bill Politico

5 Nonprofit Fundraising Laws You Should Know About

Are Your Political Contributions Tax Deductible Taxact Blog

Understanding Tax Deductions For Charitable Donations

9 Ways To Reduce Your Taxable Income Fidelity Charitable

Business Titans Pull Back From Gop After Capitol Insurrection Politico

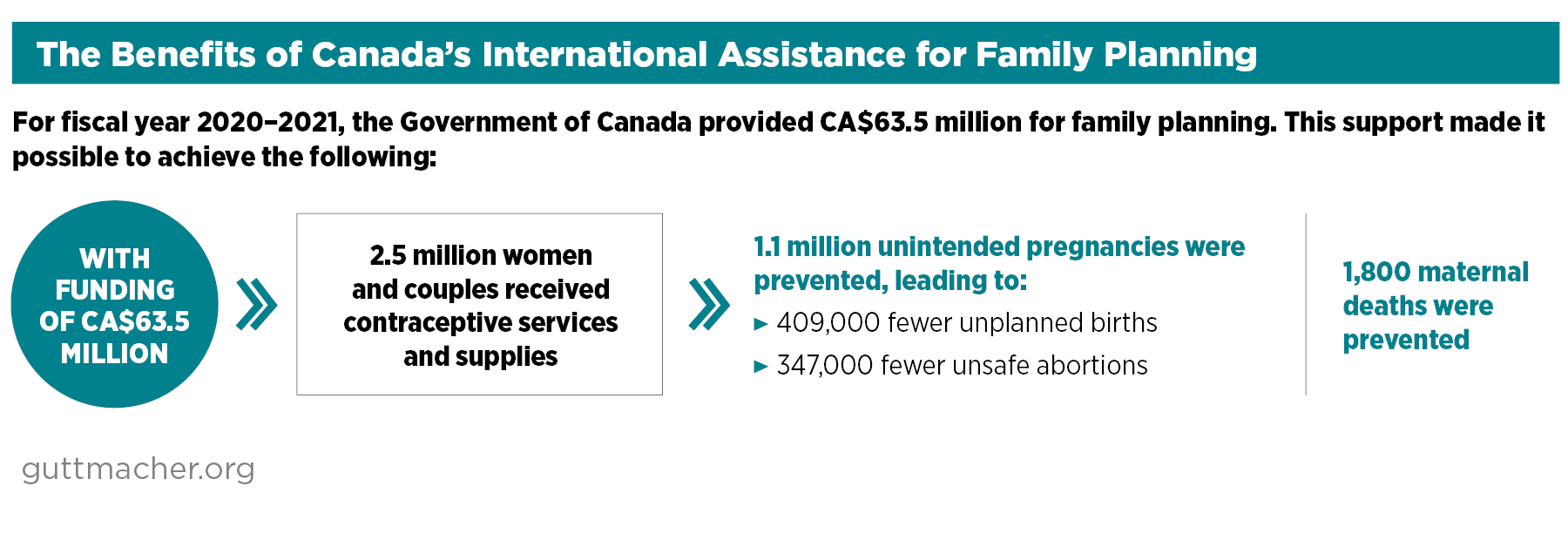

The Impact Of Canadian International Assistance For Family Planning 2020 2021 Guttmacher Institute

Roman Associates Accounting Firm Facebook

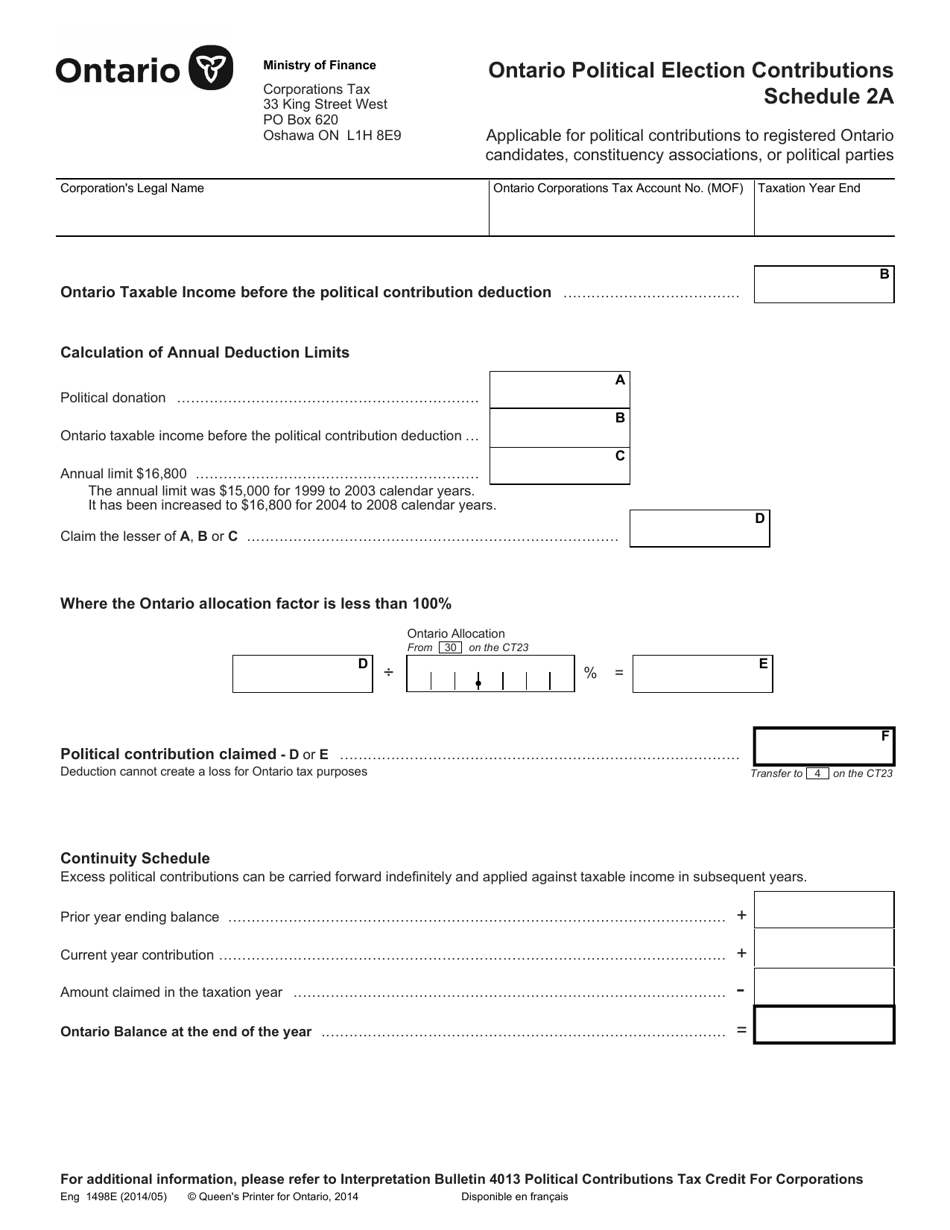

Form 1498 Schedule 2a Download Printable Pdf Or Fill Online Ontario Political Election Contributions Ontario Canada Templateroller

Tax Treatment Of Outright Gifts To Charity 2021 Cambridge Trust

Requirements For Tax Exemption Tax Exempt Organizations

How Does Your Charitable Giving Measure Up Turbotax Tax Tips Videos

A Case For A Refundable Federal Political Contributions Tax Credit Ottawa Law Review