sales tax on leased cars in illinois

The total tax for a 36-month lease would be 1056 or 1419 less than under the current formula. If you are in Chicago it is 95 this is separate from the.

What Is The Sales Tax On A Car In Illinois Naperville

If you sell a 2017 Mercedes and claim a sale price of.

. Sales taxes in Illinois are calculated before rebates are applied so the buyer who pays 9500 after a 2500 rebate will still pay sales tax on the full 12000. The amount that you have to pay for your Illinois used car sales tax or your Illinois new car sales tax depends on what city you live in. Titled or registered items Illinois retailers selling items that are of the type that must be titled or registered by an agency of Illinois state government ie vehicles watercraft aircraft trailers.

When you sell your car you must declare the actual selling purchase price. While Illinois sales tax generally applies to most transactions certain items have special treatment in many states when it comes to sales taxes. Ad Lookup Sales Tax Rates For Free.

Tags illinois lease leasing sales tax. View the Latest Promotions on Nissans Award Winning Lineup. If the down payment is 2000 the tax on that.

Illinois sales tax on lease. Sales tax on car leases in Illinois are changing as of January 1 2015. Nebraska collects a 55 state sales tax rate on the purchase of all vehicles.

Buying Leasing Selling - Chevy Volt. Interactive Tax Map Unlimited Use. Illinois collects a 725 state sales tax rate on the purchase of all vehicles.

Now with the new sales tax law vehicle leases that run for longer than one year will see a tax applied to each monthly payment which is the way it works in most of the other states across. In illinois you will pay monthly taxes as of january 1 2015 see illinois car lease tax. Tax rates vary by county and in the city of Chicago the sales tax is 95.

Under Illinois law true. This page describes the taxability of. A conditional sales agreement usually has a nominal or one dollar purchase option at the close of the lease term.

If youre buying a car for 40000 and your trade in is worth 20000 you only have to pay tax on the difference which in this case is 20000. Illinois Changes Sales Tax on Leased Cars. The se lling price for leased motor vehicles is determined either by the actual selling price or the amount due at lease signing plus the total amount of payments over the term of the lease.

Money down and trades plus your monthly payment. When an Illinois resident purchases a vehicle from an out-of-state dealer and will title the car in Illinois the sale and subsequent tax due is reported on Form RUT-25 when you bring the. Form RUT-50 Private Party Vehicle Use Tax Transaction Return.

Form RUT-50 is generally obtained when you license and title your vehicle at the local drivers license facility or currency. According to Experian Information Solutions each of the top 10 lease vehicles has a starting MSRP below than 25000. Cost of Buying a.

In Illinois you will pay monthly taxes as of January 1 2015 see Illinois Car Lease Tax. Whether the car is. What is a lease.

Like with any purchase the rules on when and how much sales tax youll pay when you lease a car vary by. Tax will not be paid with monthly payments not up front on entire value of vehicle. Sales tax is a part of buying and leasing cars in states that charge it.

Ad Lookup Sales Tax Rates For Free. In addition compared to buying leasing can lower. If you sell a vehicle to a customer who will title it in one of those states then you must charge the customer Illinois sales tax at the foreign states tax rate or at 625 whichever is less.

To enter the sales tax. Heres how the law works. Illinois law has changed so that sales tax applies to the down payment and monthly lease payments.

If the lessor is guaranteed when entering into the lease agreement that the. In other states such as Illinois and Texas see Texas Auto Leasing you actually pay sales tax on the full value of the leased car not just the leased value just as if you were buying it. Illinois taxes you on any rebates and cap cost reductions ie.

This post provides an overview of the retailers occupation tax ie. Interactive Tax Map Unlimited Use. Saying a SALE is a GIFT is FRAUD.

Most people deduct income tax but in the case that you made several large purchases you will probably receive a larger refund by claiming sales tax. Sales tax and use tax consequences of leasing equipment in Illinois.

Luxury Sedan In 2022 Luxury Sedan Sedan Car Deals

Nj Car Sales Tax Everything You Need To Know

Cars Suzuki Alto Pink Cars Suzuki Alto Pink Cars Suzuki Alto Pink Cars Suzuki Alto Suzuki Car Sharing

Illinois Car Trade In Tax Changes Starting January 2020 Honda City Chicago

Which U S States Charge Property Taxes For Cars Mansion Global

Illinois Car Sales Tax Countryside Autobarn Volkswagen

Starbucks Triple Net Lease Properties For Sale Property For Sale Commercial Real Estate Nnn Lease

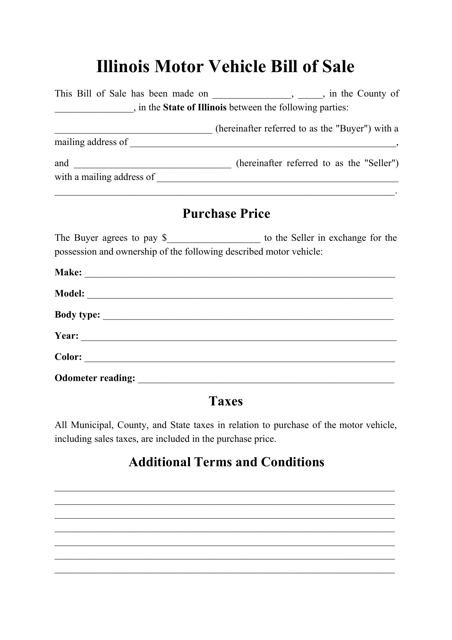

Free Illinois Bill Of Sale Form Pdf Word Template Legaltemplates

Used Cars For Sale In Illinois Edmunds

What S The Car Sales Tax In Each State Find The Best Car Price

Used Cars For Sale In Illinois Enterprise Car Sales

Illinois Motor Vehicle Bill Of Sale Form Download Printable Pdf Templateroller

How To Gift A Car A Step By Step Guide To Making This Big Purchase

Illinois Car Sales Tax Countryside Autobarn Volkswagen

Certified Used Cars For Sale In Houston Tx Enterprise Car Sales

Your Essential Shopping Companion Car Rental Renault Car Manufacturers

1976 Lancia Advertising Road Track April 1976 Old Ads Car Advertising Advertising